The 7-Minute Rule for Palau Chamber Of Commerce

Wiki Article

Top Guidelines Of Palau Chamber Of Commerce

Table of ContentsIndicators on Palau Chamber Of Commerce You Should KnowNot known Details About Palau Chamber Of Commerce All About Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For AnyoneOur Palau Chamber Of Commerce StatementsSome Known Facts About Palau Chamber Of Commerce.

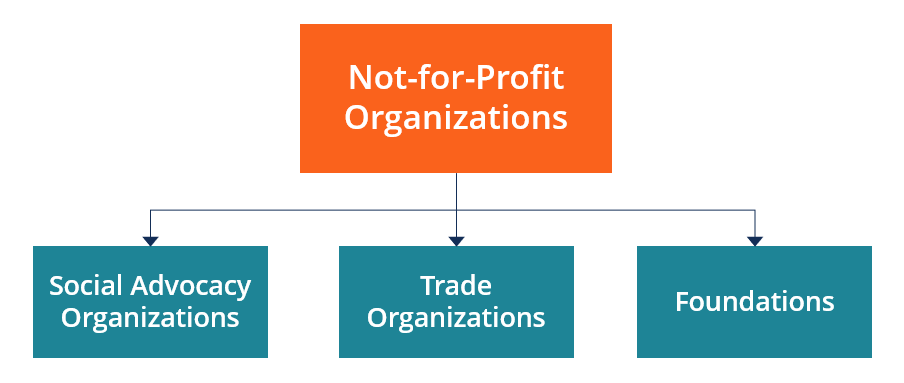

Integrated vs. Unincorporated Nonprofits When people think about nonprofits, they usually consider bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and other formally produced organizations. Many individuals take part in unincorporated nonprofit associations without ever recognizing they have actually done so. Unincorporated not-for-profit associations are the outcome of two or more individuals teaming up for the function of providing a public benefit or service.

In many cases, donors might begin with a much more modest upfront financial investment and after that plan to include even more possessions over time. Because ensuring ongoing conformity with varied state as well as government requirements can verify tough, numerous foundations involve professional lawyers, service experts, and/or other specialists to help team with regulative conformity and also different other functional jobs.

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

The assets continue to be in the trust while the grantor lives and also the grantor may handle the possessions, such as dealing supplies or actual estate. Palau Chamber of Commerce. All properties deposited into or bought by the depend on remain in the count on with earnings distributed to the designated recipients. These counts on can make it through the grantor if they include a stipulation for continuous administration in the documentation utilized to establish them.This technique swimming pools all donations into one fund, invests those integrated funds, and also pays the resulting revenue to you. As soon as you die, the depend on distributes any type of continuing to be assets to the designated charity. The simplest means to set up a philanthropic depend on is with a major life insurance policy, economic solutions, or investment management firm.

You can hire a trust attorney to help you produce a philanthropic count on as well as encourage you on just how to manage it moving onward. Political Organizations While a lot of various other kinds of nonprofit organizations have a restricted capacity to take part in or advocate for political task, political companies operate under various policies.

The Greatest Guide To Palau Chamber Of Commerce

As you examine your alternatives, make certain to seek advice from with an attorney to determine the most effective approach for your organization and also to ensure its proper setup.There are lots navigate to these guys of kinds of nonprofit companies. All properties and also revenue from the nonprofit are reinvested into the organization or given away.

501(c)( 1) 501(c)( 1) are nonprofits companies that are arranged by an Act of Congress such as government cooperative credit union. Since these organizations are established by Congress, there is no application, and they do not need to submit an income tax return. Payments are allowed if they are made for public functions.

The 7-Minute Rule for Palau Chamber Of Commerce

In the United States, there are around 63,000 501(c)( 6) organizations. Some instances of widely known 501(c)( 6) organizations are the American Farm Bureau, the National Writers Union, and the International Organization of Meeting Coordinators. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or leisure clubs. The objective of these not-for-profit organizations is to arrange tasks that cause pleasure, leisure, as my site well as socializing.501(c)( 14) - State Chartered Credit Union as well as Mutual Reserve Fund you can look here 501(c)( 14) are state chartered debt unions and common get funds. These organizations use economic solutions to their participants as well as the neighborhood, usually at affordable rates.

In order to be eligible, a minimum of 75 percent of participants need to be existing or previous members of the United States Army. Financing originates from donations and government grants. 501(c)( 26) - State Sponsored Organizations Giving Wellness Protection for High-Risk Individuals 501(c)( 26) are not-for-profit companies developed at the state degree to provide insurance coverage for risky individuals that may not have the ability to get insurance via other methods.

4 Simple Techniques For Palau Chamber Of Commerce

501(c)( 27) - State Sponsored Employee' Settlement Reinsurance Company 501(c)( 27) not-for-profit organizations are developed to provide insurance policy for workers' settlement programs. Organizations that offer workers payments are called for to be a member of these companies and also pay fees.

4 Simple Techniques For Palau Chamber Of Commerce

We review the steps to becoming a nonprofit further into this page.The most essential of these is the capability to obtain tax "exempt" standing with the IRS, which allows it to obtain donations without present tax obligation, permits contributors to deduct donations on their income tax returns and excuses some of the company's tasks from income taxes. Tax excluded standing is essential to numerous nonprofits as it motivates contributions that can be made use of to sustain the mission of the company.

Report this wiki page